From Watching to Belonging: Entertainment’s Inflection Point

Why is the Entertainment Industry Undergoing a Historic Shift?

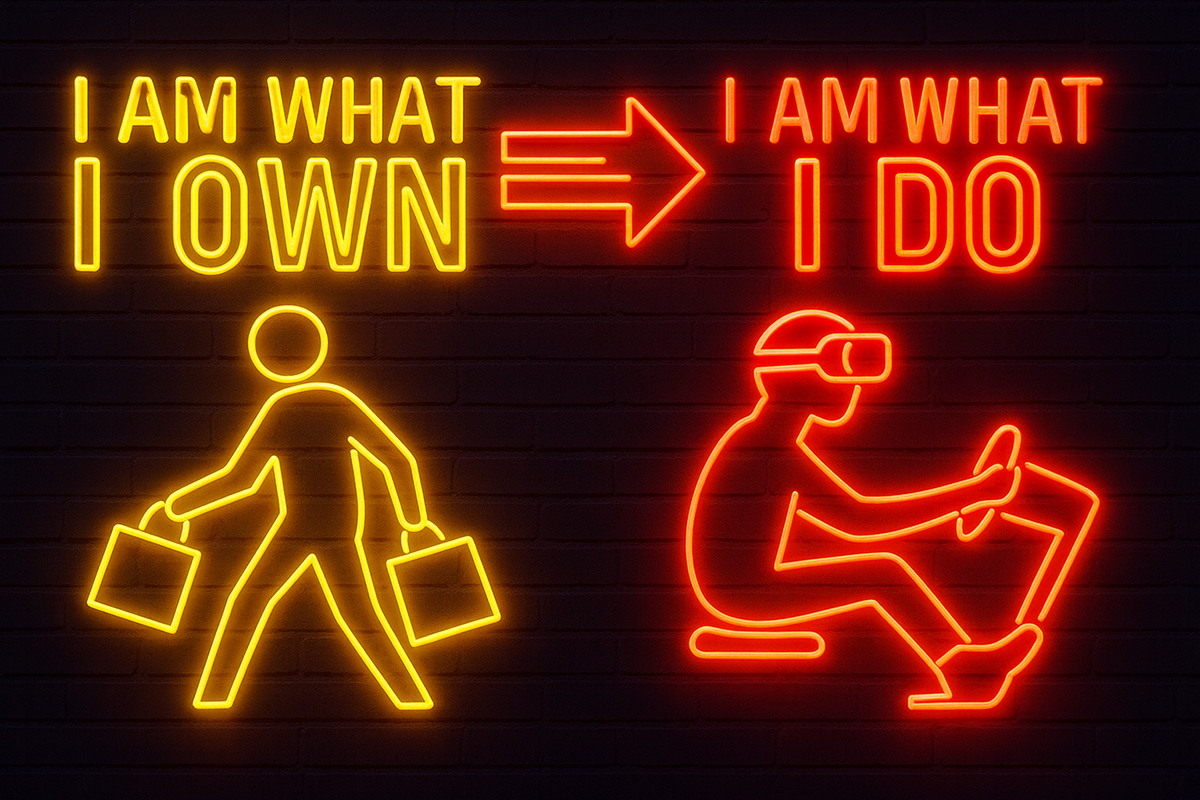

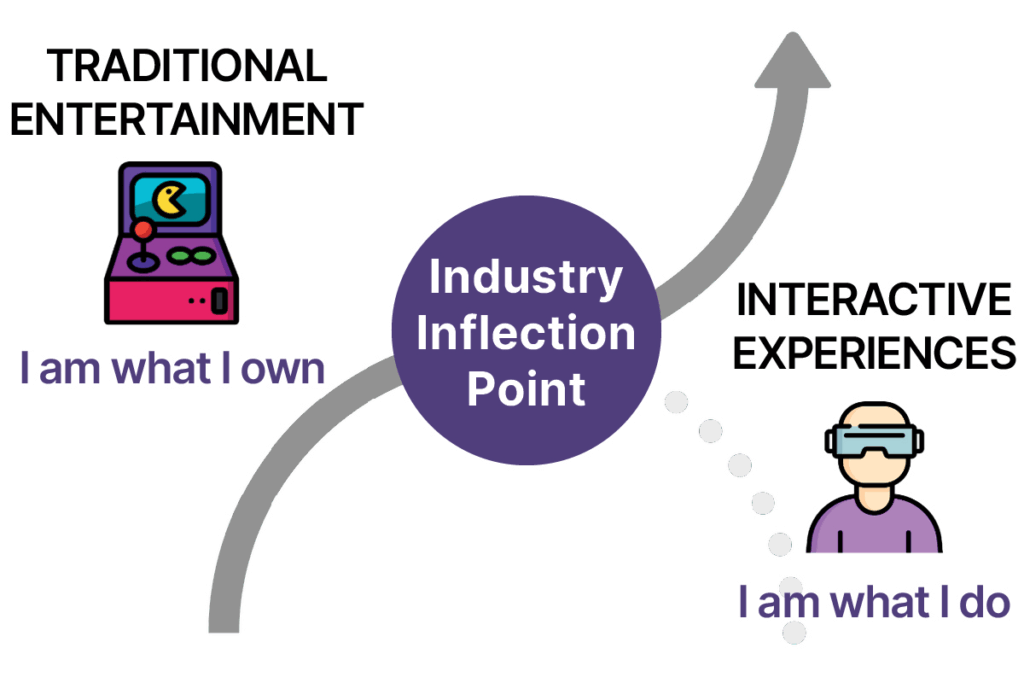

Entertainment is experiencing its most profound transformation in decades. For most of the 20th century, the model was simple: build a venue, stage a spectacle and charge admission. Identity was once defined by what a person owned, such as the car they drove or the ticket they held. That era, however, is now over.

For Millennials and especially Gen Z, identity is no longer defined by ownership, but by what they do. Their sense of self is built on shared experiences, posted moments and interactive engagement. The entertainment industry is not gradually evolving—it is flipping.

Passive, sit-and-watch entertainment is losing relevance because many of today’s audiences, particularly those under 35, reject shallow experiences. The number of people who want authenticity, interaction and involvement is growing. The warning signs of this shift are clear. From declining tourism in Las Vegas—despite billions spent on new casinos—to US malls trying to reuse outdated game center concepts that no longer resonate, younger generations want to be in the spotlight, not watching. Rather than a fad, some observers claim, this is a structural change in consumer demand. They cite surveys such as an Australian one in March 2024 that found 90% of 2,680 Gen Z respondents prefer experiences over possessions.

What Generations Are Driving This Shift?

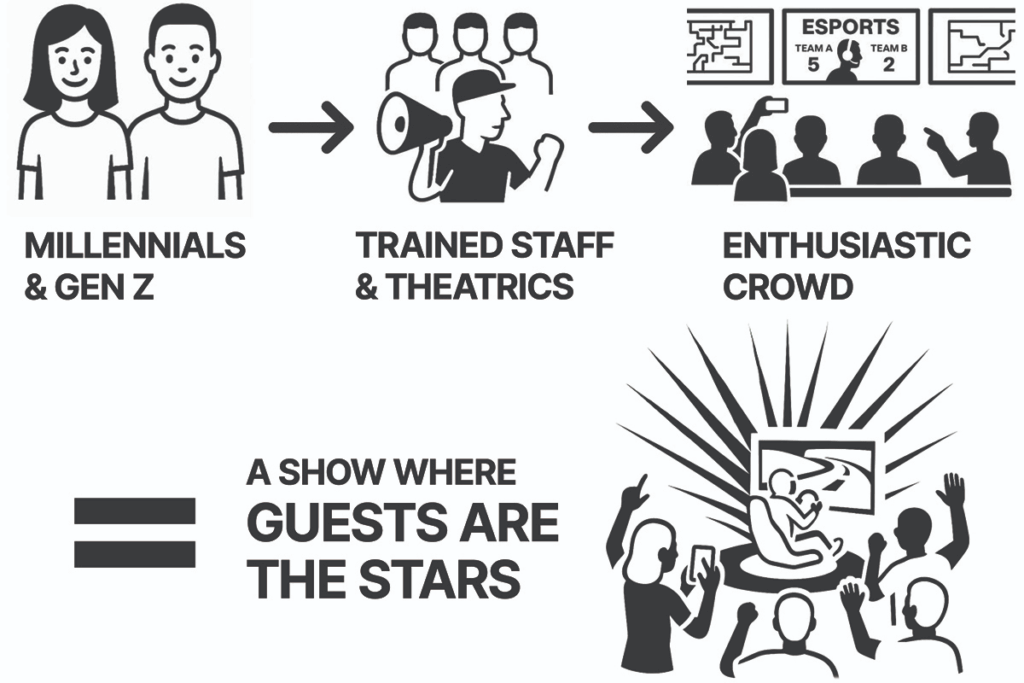

Millennials and Gen Z are the generational drivers of this change. Millennials ignited the experience economy with their “experiences over stuff” mantra. Gen Z then doubled down on this trend. As digital-natives who are hyper-connected and skeptical of inauthenticity, Gen Z is shaping the future of entertainment with their wallets and their attention. For them, passive activities such as going to museums or movies feel shallow. What matters most is uniqueness, personalization and shareability. They want to be part of the story, which is why immersive retail, esports, interactive fan zones and branded activations have exploded worldwide. The core demand is not for more spectacles, but for a sense of belonging.

What Does New Entertainment Look Like?

Based on our firsthand experience at Excape, the new entertainment model is defined by five key qualities:

- Interactive: Guests don’t just watch; they drive, perform or compete

- Authentic: Experiences feel real and not staged

- Shareable: The experience is built for social visibility and easy sharing

- Extreme: The activities are bold, enviable and brag-worthy

- Meaningful: The experiences are tied to communities, causes and identity

This new formula ensures that when the guest becomes the center of attention, the experience becomes unforgettable.

Case Study: How Did Formula E Engage Racing Fans in Tokyo and Shanghai?

Major sporting events risk losing their audience if they fail to engage fans. For its events in Tokyo and Shanghai, Formula E needed an interactive Fan Village concept to entertain thousands of racing enthusiasts. The goal was a high-energy pit stop challenge that would immerse fans in the world of motorsport. Instead of using a traditional, full-size show car—which is expensive and takes up too much space—we developed a compact pit stop challenge unit.

The unit allowed two participants to compete side-by-side with a leaderboard to keep energy high. This cost-effective and portable solution enabled Formula E to seamlessly move the activation between cities. The result was a thrilling, space-saving experience that delivered high-energy engagement, with more than 1,000 guests participating across two days at each race.

What’s the Cost of Waiting to Adapt?

For venue owners and operators, hesitation is not a neutral position; it is a direct path to irrelevance. US arenas and malls that cling to outdated attractions are seeing their visitor counts collapse. Delay equals decay. The global location-based entertainment (LBE) market is projected to grow from $5.47 billion in 2024 to $15.33 billion in 2029. This growth won’t come from traditional venues such as movie theaters or bowling alleys; it will come from immersive sports and interactive experiences that put the guest at the center.

How Has the US Experimented with New Entertainment Concepts?

The New Entertainment Checklist

- Unique

- Share-able

- Personalized

- Deep storyline

- Real / Authentic

- Engaging / Interactive

- Extreme / Seen as extreme

- Enviable / Want to be seen doing it

- Involving brands

- Supporting good causes

With its capital and entrepreneurial spirit, the US has served as a laboratory for new entertainment concepts. Some experiments have thrived, while others have fallen flat. For example, VR arcades quickly lost momentum as home headsets became affordable and the experiences felt solitary.

In contrast, indoor skydiving venues such as iFLY have flourished because they offer a physical thrill that is impossible to replicate at home while also providing the authentic, group-oriented and shareable experiences that younger generations value. The lesson from these experiments is clear: concepts that merely showcase technology struggle to endure, while those that create unforgettable participation and belonging gain lasting traction.

Call to Action for Japan: How to Seize This Opportunity?

Japan has an unmatched legacy in gaming, design and hospitality and faces a once-in-a-generation opportunity. The question is not whether this shift is happening—it already is—but rather, will Japan seize the moment or watch from the sidelines? We are already seeing signs of missed opportunities in suburban shopping malls, large-format cinemas and attractions that still rely on passive models.

At the same time, potential wins are waiting to be seized. The Japan Expo, Tokyo Dome City and automaker fan experiences have already shown how immersive and interactive concepts can capture both domestic and international audiences. With the right vision, venues can evolve into hubs of participation. Japan has the ability to adapt but will it move fast enough to implement the changes?

FAQs

How does Gen Z’s preference for experiences affect the entertainment industry?

By structural change in consumer demand. As a hyper-connected generation, they are seeking authentic, interactive and shareable entertainment that they can be a part of, rather than just passively observing.

What is location-based entertainment (LBE)?

Entertainment that is experienced in a physical location. The market for this type of entertainment is projected to grow significantly, driven by a demand for interactive, immersive and social experiences.

How can a business adapt to these new entertainment demands?

By focusing on interactive, authentic and shareable experiences. This means putting the guest at the center of the experience, allowing them to participate and create their own memories, rather than just watching a performance.